Hello Readers, this post

is about royalty management in Dynamics 365 F&O. Below are few set of

questions that pops up in mind when we say 'Royalty':

- What is royalty?

- Why one should pay the

royalty?

- On what products and

services, one should pay the royalty?

- Which parties are

involved in royalty agreements?

- How D365 F&O

manages the royalty life cycle effectively?

These and other set of

questions that I am going to address in this post.

Royalty is a monetary reward (Payment or Fee) given by

one party (Licensee) to another party (Licensor). Those two parties are 'Licensor' and 'Licensee'. Licensor

is an entity (Person/ Organization) who owns the asset or Intellectual property such as Patented product. Licensee is an entity who is seeking the rights to use

those assets or intellectual property to earn the revenue and pay the royalty (share) on every sell that happens as per the agreement.

Royalty assets are nothing

but an intellectual property solely own or patented by the licensor. Licensee

has to sign an agreement with Licensor that is called royalty agreement which

mentions all the terms and conditions for using the

intellectual property/ Assets. The payment that is being made to licensor by

the licensee is called 'Royalty'.

The entire royalty life

cycle, right from getting into the agreement by both the parties after the

terms and conditions are agreed upon to processing the royalty claim for

facilitating the payment to licensor is manage effectively in D365 F&O.

Advantages of royalty management

- It will reduce the manual and administrative error occurs while managing royalty life cycle

- By accruing for future payables, cash flow forecasts can be Improve

- Different terms and conditions of royalty contract can be accommodate effectively in royalty agreement

So, let's get started with

the setup in the system:

Enable configuration key

First thing is to enable the configuration key for royalty (if not enabled already) from the license configuration setup in order to use

royalty management functionality in D365 F&O.

- Go to system administration >

Setup > License configuration

- Ticked the Royalty checkbox under Trade > Trade agreements section (if not ticked already)

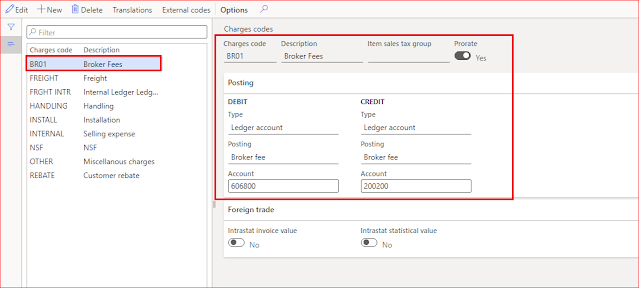

Account payable parameters

1. Go to Accounts payable > Setup > Accounts payable

parameters

2. Click on Broker

and royalty tab > Royalties section

3. Starting day

of week: It is used when cumulating the royalty by week. If 'Sunday' is selected, the it will consider a week from Sunday to following Saturday for cumulating the royalty by week.

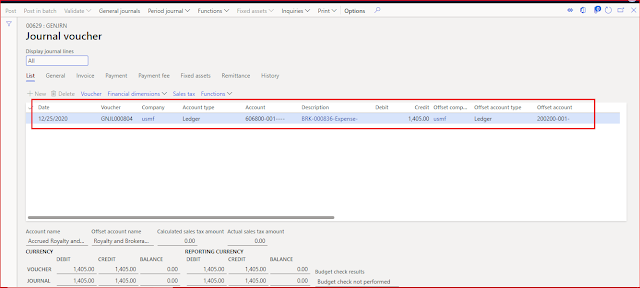

4. Accrual

journal name: It is the daily journal which will be posted when royalty

claim is approved

5. Accrual

account: It is the main account (Liability account) which will be credited when accrual journal

is posted

6. Expense account: It is the main account which will be debited when accrual journal is posted

7. Procurement category: It is the default procurement category for royalty.

8. Once values are entered for the above fields in Broker and

royalty tab, go to Number sequence tab in accounts payable

parameters

9. Select the number

sequences for royalty contract, royalty code, royalty claim ID, royalty claim

vendor invoice id as these are required while generating royalty claim, royalty

claim vendor invoice etc.

10. Once setup is done, system is ready to create royalty agreement

for setting up the terms and conditions which are agreed upon.

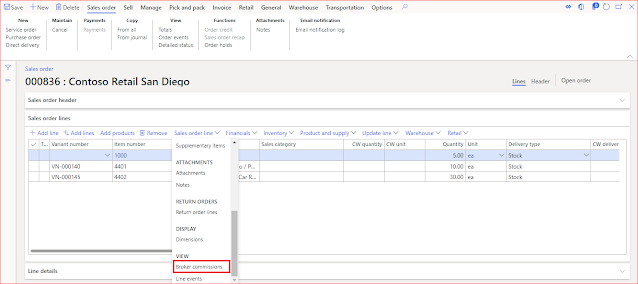

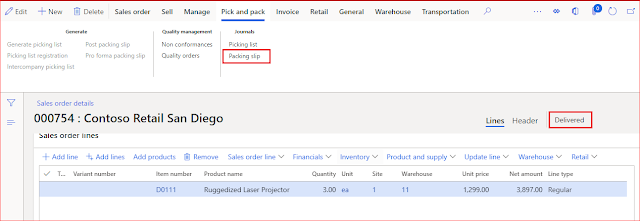

Create Royalty agreement/Contract

Set up the royalty agreement between licensor and licensee which

will be approved and applied to sales order for royalty payment calculation.

1. Go to Accounts payable

> Broker and royalties > Royalty agreements

Upper pane

2. To create new agreement, click 'New'

Note: Royalty contract id will

be generated automatically from the number sequence selected in Accounts payable parameters

3. Vendor account:

Select vendor account. The royalty will be paid to this vendor (Licensor), once claim is

settled

4. Description:

Enter the description to identify each agreement uniquely such as 'Trademark

royalty'

5. Unit:

Select unit of measure such as ea., pcs etc. depending on what products will be

sold as a part of royalty agreement

6. Unit type:

Once unit is entered, select unit type that can be Inventory unit or Catch

weight unit (for perishable items) that is represented by the

product. Select the value from the dropdown

7. Unit of

measure royalty options: This can be Convert or Exact

match i.e. whether unit for the item in sales order should exactly

match with unit given in royalty agreement or should the conversion be allowed.

Select the value from the dropdown

8. Calculation

date type: It is the date which is to be considered from sales order line(s) while

calculating the royalty such as, created date, requested ship date or requested

receipt date. Select the value from the dropdown.

9. Start date and

end date: Enter the date during which royalty agreement will be valid.

10. Cumulate sales by: how do you want royalty to be calculated i.e. per invoice, per week, per month, per year or by other specific date. It specifies the period for royalty calculation (Week, month, year). If invoice is selected, the royalty will be calculated automatically every time eligible sales order line is invoiced. (In this case royalty claim directly gets the status as 'Calculated'). Select the value from the dropdown.

11. Price (taken

from): Which amount from the sales order line should be considered for

calculating the royalty such as net amount or gross amount. Select the value

from the dropdown

12. Accrual

accounts and expense account: Values for these fields will be copied

automatically from the accounts payable parameters and can be overridden in the agreement. These are used while posting the accrual journal when royalty claim

is approved

13. Currency:

Select the currency for royalty agreement. Royalty payment terms will be in this

currency which will be used in royalty calculation

14. Calculate by:

How do you want to calculate the royalty i.e. by quantity or by amount. Either the quantity or the amount (Net or gross) will be considered from sales orders to determine the tiers for applying the royalty amount (For example: if quantity is selected, the overall quantity from the sales orders in the given period will be considered to decide which royalty amount will be applied from the agreement for royalty calculation)

15. Validation: To validate the agreement, click on Validation button in the upper pane of the agreement. Validated checkbox will be ticked automatically when royalty agreement is

validated

16. Approval required: It should be ticked manually if approval is required while processing the royalty claim

18. Once values are entered in upper pane, fill in the details for lower pane to make this agreement ready to use.

Lower pane

To enter the details, click on 'Add line'. Here we are creating an example where 7 USD per unit of royalty will be paid for items 1000 and 4402 if quantity is sold between 1 to 1000 and 9 USD per unit of royalty will be paid if quantity is sold between 1001 to 5000. Beyond 5001 quantity, 10 USD per unit of royalty will be paid.

19. Royalty code and description: Royalty code will be generated automatically from the number sequence and description will be copied from the header automatically which can be override if require

19. Vendor account, calculation date type, currency, unit, start date and end date will be copied automatically from the header level (Upper pane). These details can be override if require for each royalty agreement line

20. Amount type: The amount type can be Amount per unit, Fixed amount or Percentage. Once royalty amount is entered in the royalty agreement, that amount will be applied to sales order as per the amount type. For example, If Amount per unit is selected in the Amount type field and royalty amount value is 7 USD for some specific quantity then it means 7 USD per unit of royalty will be calculated when applied to the sales order

20. Now go to selection tab, click on add line/ Add lines to enter the item(s) for which royalty will be paid

21. Enter unit, site and warehouse for the selected item(s)

22. Once item(s) are entered, go to Royalty amounts tab for setting up the royalty amount values for specific quantities or amounts (depending on what value is selected in calculate by field)

23. Enter From value and To value. It can be quantity or amount depending on calculate by field value

24. Enter the value for calculating the royalty. In our case we have selected Amount type as 'Amount per unit', and value selected here is 7 USD for 1 to 1000 quantity, it means for quantity up to 1000, royalty will be 7 per unit and so on.

25. Once values are entered, it is time to validate the royalty agreement to verify if all the mandatory fields are properly entered and no business rules are violated

26. Click on validation button. You can see worker id associated with your user account will come in validated by field. Click ok

27. Once validation is done, you can see validated checkbox is ticked automatically. Also see the worker name in the validated by field (worker associated with your user account)

Note: Upon validation, this agreement will be disabled and no further changes are allowed.

Hope!! Everyone gets clear understanding of how setup is being done for enabling royalty claim for orders in D365 F&O

Please post if any queries and do let me know if any suggestions for improvement.

See you soon with new post

Happy D365ing !!!

-------------------------------------------------------------------------------------------------------------------