Hello Readers,

Happy to see good responses on my earlier posts, it really motivates me to share my learning with you all.

Today I am going write about Free text invoice.

Free text invoice is basically the invoice without sales order. Free text invoice is for sales but it doesn't require any sales order. Also there is no inventory tracking involve, so there is no picking and packing require in free text invoice.

Free text invoice can be used for service fee or consulting fee or miscellaneous fee for any kind of reimbursement

Path to create Free text invoice

Account receivable --> Common --> Free text invoices --> All free text invoices

Example:

Go to AR --> Common --> Free text invoice --> All Free text invoice

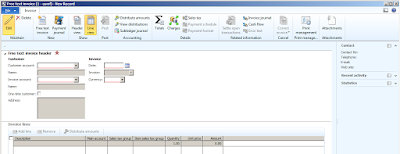

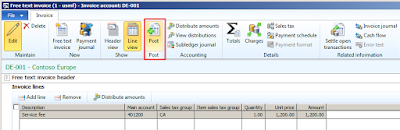

Click on Free text invoice button to create new free text invoice.

You can see customer account is mandatory as here we are generating the invoice so it has to be for customer.

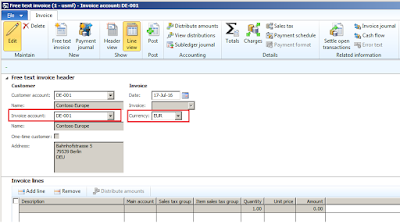

Select customer account from the drop down list in the free text invoice header.

Note: Once you select customer account, the invoice account and currency field values comes automatically as those are setup in the customer master. User has the liberty to override those values in the free text invoice form,

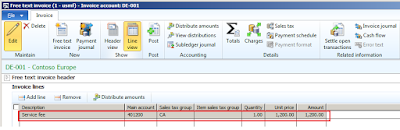

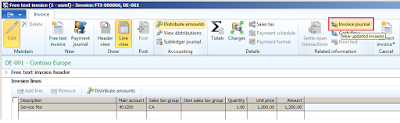

Now go to Invoice lines --> Click on Add line

Enter short description which provides information about free text invoice. This description is then printed on the invoice.

Select main account- it should be a revenue account as free text invoice is an invoice for customer against which we will earn revenue and that revenue need to be updated in the ledger.

Sales tax group: it flows automatically if it is setup in the customer master.

Item sales tax group: select item sales tax group from the drop down list in invoice lines.

Select quantity (in case of service, it is the number of times, the service is rendered to a customer)

Unit price: Enter the per unit price.

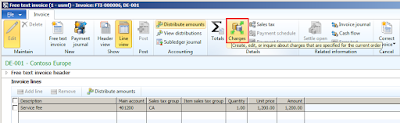

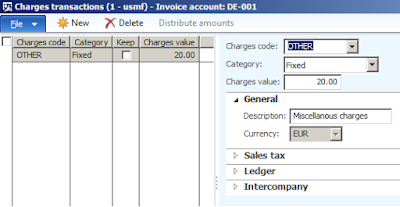

We can add charges if any in the free text invoice,

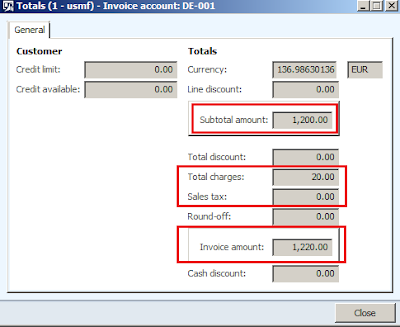

Click on Total to see all the required details of the Free text invoice i.e. Subtotal amount, Total sales tax calculated, Total charges applied, Total discount if any, cash discount and invoice amount.

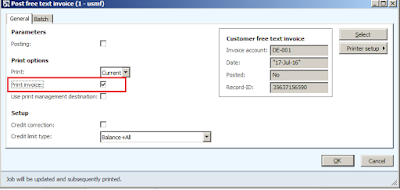

Post free text invoice

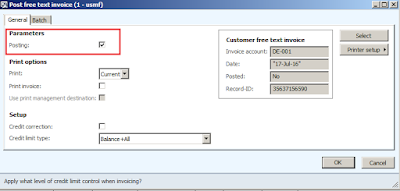

Click on Post button to post free text invoice.

Note: Make sure Posting checkbox should be ticked.

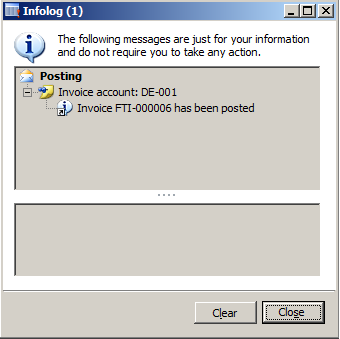

Click OK to post the invoice.

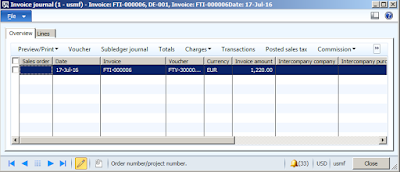

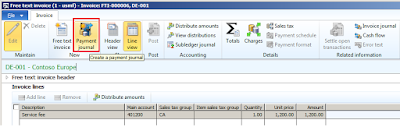

Go to invoice journal

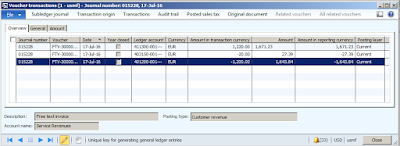

Click on Voucher

You can see customer posting profile account (Customer balance) get debited and Customer revenue account (main account tag in the FTI) get credited.

Note:

Charges and sales tax are incurred on customer hence it will get credited (separately from customer revenue) and this will get debited with the customer balance ( i.e. customer will bare both charges and sales tax ). It is depending on the mutual agreement between customer and company on bearing of the charges and accordingly setup will be done in AX.

Note:

Proforma invoice: if you wish to print proforma invoice then make sure to clear posting checkbox and select print invoice checkbox.

Payment journal

In order to settle the free text open transactions, AX facilitates the creation and posting of payment journal directly from free text invoice form.

In this way, you can create and post Free Text Invoice in AX.

Hope! this post provide you with the understanding of Free text invoice in AX 2012 R3.

Please post if any queries or suggestions pertaining to this topic.

Happy Daxing!!!

"Knowledge has no value unless you use and share it." Keep sharing !!!

------------------------------------------------------------------------------------------------------------------------------------

Abhijeet Hele | Dynamics AX Enthusiast | My Profile |

The information provided on this site represents my own opinion/view and does not represent the opinion/view of my employer or Microsoft.